It’s that time of the year, when you may be looking at different finance options for your new car. With 191 car registrations on the horizon, it’s important that you inform yourself on the car finance deals that are on offer and consider all your options before signing on the dotted line.

At Core Credit Union, we are advising our Members to set a budget when purchasing a car and sticking to it. Often Members can be swayed by dealer finance on offers, which results in purchasing a car without considering all the facts.

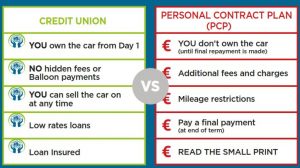

The key difference between a credit union loan and a dealer finance, is that you own the vehicle from Day 1 with a credit union loan. With PCP with dealer finance, you are effectively renting the car as you don’t own it until the final repayment is made.

Michael Byrne, CEO Core Credit Union states “We are advising our Members to be practical when looking at car finance. With PCP/Dealer Finance there may be deposits required at the start, balloon payments at the end as well as mileage restrictions.

Michael continues, “With a Core Credit Union loan, there are no fees, and no charges, you have the flexibility of clearing your loan early without any penalty. Core Credit Union offers free Loan Protection and Life Savings Insurance so in the event of your death or permanent disability your loan is cleared. With dealer finance, there is no such protection, so repayments will still have to be made or alternative arrangements made to pay outstanding debt.”

Michael adds “Core Credit Union has 7 offices, so a local credit union branch is never too far away. Call and ask for a car loan quote today. It’s worth putting in the time to study and understand the different finance options available, it will save you money in the long run. Headline rates on some car finance deals such as PCP’s can easily distract from a range of additional charges, and a great deal of inflexibility. With a personal car loan from Core Credit Union, you own the car from the outset. If you run into difficulty, you can talk to us about adjusting the repayment schedule and if you are in the happy position of being able to repay the loan early, you can do so without any complications or rescheduling fees” he concludes.

PCP’s are among the least flexible forms of finance. Essentially they are lease schemes which makes financing a new car seem affordable due to low monthly repayments. You have hired the car for a particular period of time, (usually 3-5 years, while you make these repayments). At the end of the agreement, you will have to make the balloon payment in order to own the car.

Michael continues “If you arrange finance with Core Credit Union before going shopping for a car, you are in a much stronger position. You are effectively going as a cash buyer to the car dealer, and may well be able to negotiate a better deal.”

Some things to consider before signing a PCP: